Generally, merchant cash advances are restricted in the sense that they must be used to grow your business, but that’s all. You can’t receive a merchant cash advance from a reputable provider and use the funds to buy your me-ma’s 70th birthday gift, or that new home you’ve been eyeing. But the application of merchant cash advances is quite broad. Let’s look at a few possible scenarios on how a merchant cash advance can be used to take your business to the next level.

Jayne’s Diner Wants to Expand

Let’s assume that Jayne’s Diner, a thriving establishment on Manhattan’s Upper East Side, is looking to expand. Having been in business for one year, it doesn’t have the historical financial documents necessary to obtain a loan. Jayne’s Diner is profitable, always packed – you just can’t get a seat there, especially during lunch and on the weekends, and has established notable roots within the Upper East Side community. Jayne, owner of Jayne’s Diner, would like to expand the diner by leasing a vacant storefront next door and transforming it into an extended dining area.

After meeting with the building manager, Jayne learns that if she signs a lease within the next 7 days, Jayne’s diner would be eligible for 2 free months, which would be a huge help as she will have to renovate the storefront to match the diner’s brand as well as purchase additional tables, chairs, etc… Upon reviewing her finances, Jayne determines that the diner doesn’t qualify for a loan, but she needs additional capital.

Jayne performs research and applies for a merchant cash advance the next day. Jayne provides all the information necessary and is provided with an advance of $150,000 the next day. She immediately uses her merchant cash advance to lease the storefront next door and purchase tables and chairs.

Tom’s Trucking Must Pay Bills

Tom Trucker, owner of Tom’s Trucking, has recently determined that he wants to apply for a merchant cash advance to pay past due bills. Tom’s has always paid its bills on time, but Tom was sick for a few months not too long ago and this set the company back quite a bit. Tom’s is, for the most part, a healthy business. It has three big rigs on the road 322 days throughout the year and is run by both Tom and his wife, Mary.

Tom applies for a merchant cash advance and is provided with $55,000 in funding within a few days. He quickly uses $20,000 to pay past due bills and the remaining $35,000 to purchase an additional big rig for the company. He believes the return on investment that he’ll see with the fourth big rig will not only enable him to pay the advance back on time, but also have money left over each day. Tom used the funds he received from the merchant cash advance in a manner that he thought would best serve his company.

Mary’s Muffins

Mary’s Muffins is a tiny hole-in-the-wall muffin shop located in Boise, ID. Before opening Mary’s Muffins, Mary became somewhat of a local celebrity when she baked muffins for her daughter’s PTA school charity event. Buying into the hype, Mary opened a little muffin shop and it has thrived ever since. Mary’s at the stage where she’s plateaued and needs to expand her operations if she wants to make it big time. Mary sets out to have Mary’s Muffins in the frozen dessert section of Grocer Gate, the local chain of grocers.

Although Mary’s Muffins has money in the bank and Mary has some savings stashed away, she’d prefer not to deplete the business of most of its funds or dip into her personal accounts. She planned on taking a week or so to perform research and consider her options but is so inspired while in the frozen dessert section of Grocer Gate later that evening, she immediately goes online and searches for a way to acquire the necessary funds.

She determines that the loan process is too lengthy but comes across an article discussing merchant cash advances. Unsure of whether a merchant cash advance is for her and the basic legitimacy of this alternative source of funding, Mary continues performing research until she feels comfortable applying for one. She completes her application, her information is verified, and she’s funded within two business days.

Merchant Cash Advances Offer Opportunities

Merchant cash advances provide you with the ability to both sustain your current business operations or engage in new ones. Whether you’re looking to pay your bills, like Tom, expand your current operations, like Jayne, or enter a new space entirely, like Mary, the working capital provided from receiving a merchant cash advance can help you take that next step. Another benefit of the merchant cash advance source of funding is that you are selling a percentage of your future receivables, not equity in your business. By selling a percentage of your future receivables and not an ownership stake in your business, you both remain in control of your business and can profit more in the long-term than you would if you sold an equity stake.

Next Steps

Before deciding on whether a merchant cash advance is appropriate for your business, you should perform as much research as possible. Make sure you truly understand what a merchant cash advance is, how it works, and what each funder both offers and requires. It’s critical that you spend the time necessary familiarizing yourself before taking the next step and applying. Additionally, be sure to read each contract and seek clarification before signing and receiving funds.

Employee engagement directly impacts an organization’s turnover and retention rate. Low levels of employee engagement can cost an organization more than it costs to simply hire and onboard a replacement. From employee morale to customer service and beyond, employee turnover impacts an organization at all levels. It’s no wonder why organizations spend billions of dollars annually on employee turnover.

The more engaged employees are, the less likely they are to be dissatisfied and leave their employers. How do you keep employees engaged? Below is a list of ten easy-to-implement ways to engage your employees on a consistent basis.

- Encourage Creativity

Creativity serves two critical functions when it comes to employee engagement. First, employees who are encouraged to be creative and develop novel ideas and solutions to problems experienced within their jobs are more likely to feel valued by their employers. Employees feel valued more when their employers encourage creativity because it provides them with a meaningful voice and a megaphone within their organization. They are encouraged to contribute to the organization as a whole, no matter how small or large their actual assignment is, in a way that is meaningful to them.

Encouraging creativity within employees provides those employees with an extended license to be themselves. Oftentimes, employees are faced with boring procedures through which they must approach their daily activities. Although encouraging creativity won’t necessarily remove such formalities from employees’ daily lives, it’ll provide them with the opportunity to be themselves and contribute more meaningfully to their employers.

- Promote Positivity

Employees are consistently overworked and underappreciated by their employers. If they’re not overworked or underappreciated, they still might feel like they’re carrying the weight of their departments while their efforts go unnoticed. When this happens, employees are surely going to become gradually disengaged from their roles, which will cost their employers. Additionally, such disengagement will lead to a decrease in employee morale as others must step in to carry the weight that the now disgruntled employee once carried.

Promoting positivity within your organization costs very little and comes with a huge payoff. In fact, there are several benefits to promoting positivity. First, employee morale will improve. It’s human nature to mirror the feelings of those around them. Promoting positivity and happiness throughout your organization will lead to employees enjoying their workplaces more, also resulting in increased productivity. Second, customer service will improve. Increased employee morale will result in happier employees, which will, in turn, trickle down to your organization’s customers. Third, promoting positivity throughout your organization will result in lower employee turnover and higher retention.

- Recognize Employee Achievements

No matter what industry you’re in, human capital is the backbone of your organization. Your employees, whether you have many or few, are what keep your organization operational. Too often, employees make incredible achievements and their employers approach such achievements with the wrong mindset. Although employees are compensated by their employers to perform certain functions and achieve particular goals, such achievements should not go unnoticed. It is important to remember that employees are people and people need recognition. While it is unnecessary to break out the bright lights and trumpets when recognizing your employees’ achievements, it is unwise to overlook them. Although they’re compensated for their actions, employee morale begins to decline as more and more of their achievements are overlooked.

Recognizing employee achievements doesn’t require too much effort. The importance of recognition is in the act itself, not the form with which it is implemented. A simple meeting with an employee to recognize an achievement or a company-wide email can have the same impact on an employee’s morale. It doesn’t stop there, though. Recognizing employee achievements also improves morale within those employees who have not accomplished recognition-worthy achievements. It feeds into promoting positivity within the workplace and improves every part of the organization.

- Continuously Train Employees

Most employees aspire to grow and develop overtime. Whether their motives are to be able to afford a better home one day, put their children through college, or change the world, they are valid and important. Employee development should be taken very seriously by organizations as it critically impacts many parts of an organization over time. Continuous employee training results in increased employee engagement and retention, reducing their employer’s overhead exponentially over time. Ongoing training activities not only improve employees’ job performance, but also signal that the employer is invested in the success of its employees.

Too often employees are hired, onboarded, and left to fend for themselves. Their direct supervisors slowly overextend them with work that goes beyond their skills. In the beginning, it’s okay. Over time, however, the level of work beyond employees’ known skills becomes a burden and morale begins to decline. In addition to improving employee morale on an ongoing basis, ongoing training also helps to attract quality candidates when looking to onboard new employees.

- Engage in Team Activities

Team activities in the workplace help to build a sense of community within an organization. Whether your organization is made up of 5 people or 500 people, team activities enable employees to bond and grow with their colleagues in a manner that’s less formal than they would otherwise while they’re fulfilling the functions of their job. Team activities don’t have to be purely recreational. In fact, some of the best team activities can include several colleagues working together in a more relaxed manner with the objective of producing a piece of high-quality work for their employer.

- Implement Volunteering Initiatives

Often overlooked in smaller businesses, volunteering initiatives are an excellent way to improve employee engagement levels throughout your organization. People are generally good. However, not all good people have the time or are willing to find the time to volunteer for different causes they are passionate about. Studies have shown that employees are becoming more and more willing to leave an employer if the employer does not offer meaningful opportunities to give back.

Volunteering initiatives should be meaningful but don’t need to consume too much of your organization’s resources. Don’t implement a volunteer initiative to simply retain employees, that won’t work. The key here is to have employees engage in some meaningful form of giving that adds value to the intended beneficiaries of such efforts. Effective volunteer initiatives are generally done on the clock and together as a team.

- Add Plants

Plants improve office aesthetics, which often decrease employee morale. Research shows that offices with no plants exhibit productivity levels that are 15% lower than those that have a few simple houseplants in them. Plants add a lively burst of energy to the spaces within which they are located and increase employee morale and productivity, leading to increased engagement and reduced turnover rates. They offer wins all around.

- Give Employees Individual Attention

A critical mistake that many organizations make, especially small businesses, is failing to provide each employee with individual attention. Although employees are part of a team while they’re at work, each still has individual goals. While one employee is simply working to pay rent, another employee aspires to be a manager. Employees have their own goals and identities, and it is critical for organizations to not only understand their unique identities, but also embrace them.

Providing employees with individual attention requires a bit of time and finesse, but proper execution can yield huge dividends for your organization. When providing individual attention, make sure it’s individual and about the employee specifically. Don’t approach providing individual attention in a group setting as it will reduce the impact of the attention given. Additionally, don’t focus exclusively on the individual within the context of the team on which the employee sits. This, too, will reduce how meaningful the attention is perceived. Focus on the employee as a person and how this employee can improve his or her career within your organization.

- Provide the Right Tools

There’s nothing worse for an employee than being tasked and not having the appropriate tools to do the job. Could you imagine cutting a tree with a Swiss army knife? It’s certainly possible, but it’ll take a painstaking number of hours and you’ll likely be frustrated along the way. This is what it’s like for an employee who’s tasked without the proper tools. This is especially the case when other members within their organization are relying on them for deliverables.

Not having the correct tools to perform the functions of one’s job leads to increased stress, anxiety, and decreased morale. In fact, morale can plummet due to an inability to perform a job well because of factors that are beyond the employee’s control. Providing employees with the right tools for their jobs increases productivity and engagement, resulting in increased morale and retention.

- Listen to Employees’ Concerns

Employees are the backbone of every organization. Oftentimes, employees express concerns that go unheard and unaddressed. They either don’t have a forum to speak or their supervisors don’t take the time to listen. Listening to employees’ concerns serves several important functions within an organization. First, and most importantly, it provides employees with a meaningful voice. As noted earlier, this is critical to employee engagement because employees are human and want to be heard. Second, it provides organizations with critical feedback on potentially larger issues within the organization. Third, it provides the organization with the opportunity to get ahead of potential liabilities while simultaneously improving employees’ experiences in the workplace.

Employee turnover is often overlooked in small businesses. The process of hiring and firing employees is viewed as a necessity, but turnover causes and effects are not looked at on a granular level. The reasoning behind why an employee departs is often not taken into deep consideration due to a perceived lack of time or resources, but very little thought is given to the amount of time and resources that will be gained by retaining employees longer.

This article begins by looking the true costs of employee turnover and how excessive turnover can begin to destroy a small business. From there, we then dive into looking at what employees really want and how they approach getting it. We end with a look at why employees leave and what employers can do to improve their retention rates.

- True Cost of Employee Turnover

Employee turnover impacts every part of an organization, from team quality to overhead, and especially morale and customer service. Employee turnover is often thought of as an isolated incident. Employee X is no longer with the company, so we must replace employee X with employee Y. However, this is a wildly inaccurate way of viewing employee turnover. Businesses are made of interconnected webs of individuals, usually in teams, whose functions within the business rely on one another.

When one member of any team within a business departs, there are several costs that are associated with such departure. The most commonly recognized cost is advertising dollars spent to attract quality new replacement candidates. This includes online advertisements, career fairs, and other means through by which the business attempts to attract replacements.

The second cost is onboarding and training. While it’s not commonly thought of as a cost because it’s a necessary function for the operation of the business, onboarding and training costs add up. In addition to this, there is a third cost that is closely related: employee inefficiency. The cost of employee inefficiency is exhibited every time a new employee joins a business and is highest when a more seasoned employee departs. Without proper preparation over longer periods, the teams on which the now departed employees once sat are often burdened with carrying the weight of the former employees.

The fourth cost, which is also closely related, is employee morale. As employees are burdened with more work, they become overworked and employee morale begins to decline. As more and more members of the business depart, and it begins to look more like a revolving door, employee morale begins to plummet. Frequent turnover leaves employees uneasy and questioning their job security.

The fifth cost, which is incrementally reduced by each of the preceding four costs, is reduced customer satisfaction. Customer satisfaction is key in any business. After all, customers are the ones who ultimately pay the bills and provide the profits. As employees leave and replacements are brought in, productivity, product knowledge, and confidence begin to decline. Customers want information and they want it fast. Employee turnover can slow the information gathering and task execution process down to a snail’s pace.

The sixth cost, closely related to the fifth, is customer loyalty. Even the most loyal customers who have started experiencing deviations in the quality of the services they are receiving are likely to jump ship over time.

- What Employees Really Want

People agree to become employees for different reasons. One individual might join a business for self-motivated reasons while another takes a purely altruistic approach. Assuming everyone performs the job as agreed upon entering the business, the reasoning behind the decision to join doesn’t matter. What’s important is what these individuals want after joining the business.

First and foremost, employees want to know that they are a valued member of the business. This doesn’t mean bright lights and trumpets are necessary but listening to employees and enabling them to have a unique voice is key.

Second, employees want to know that there’s room for growth within the company. Unless the individual is specifically looking for a short-term position to help bridge the gap between being unemployed and being employed at their next job, growth potential is important. Growth potential comes in many forms, but the most common two are additional responsibilities and increased wages. Enabling employees to grow within your business throughout their careers provides them with a sense of stability, resulting in increased engagement and reduced levels of employee turnover.

Third, employees want to work for a company that they can identify with and one that makes them proud. People are generally good and those who aren’t don’t go around telling others. Generally, employees want to work for an employer who has some sort of volunteer initiative implemented throughout the business. Employees like being provided with the opportunity to give back while doing it on the company’s dime. Volunteering together also enables colleagues to get to know and engage with each other in a less formal way.

- How to Retain More Employees

Employees leave for many different reasons. Some employees have found seemingly better opportunities, others feel unappreciated, and still others don’t see growth opportunities within the company by which they are employed. No matter their reasons for leaving, employers can reduce their employee turnover rates by focusing the areas outlined above. By giving employees individual voices, enabling them to grow within the company over time, and showing them that the company cares about giving back, employers will be able to retain their employees for longer periods of time.

Employees want to know that they’re not expendable. In a world where robotic process automation and skilled laborers are flooding the market, employees want to know that there is stability and security in their jobs. Focus on improving your employee engagement rates by implementing the advice mentioned throughout this article and you’ll notice a gradual decline in your turnover rates and an increase in your customer satisfaction and loyalty.

A merchant cash advance is an upfront lump-sum payment for the purchase of a contractually specified percentage of a business’ future receivables. That’s a mouthful, so let’s break it down into simpler terms. As a business owner, you sell either goods or services. Each sale that you make is called a receivable. Sales that you expect to make in the future are referred to as ‘future receivables.’ A merchant cash advance is simply the purchase of some of your future receivables, which are really speculative investments for the funding provider, for payment now.

Is that really it? No, there’s more.

Merchant Cash Advances Are Speculative

For you as a business owner, merchant cash advances can provide the working capital necessary to pay your operational expenses, purchase new inventory, hire additional staff, or expand into new markets. For merchant cash advance providers focused on providing business owners like yourself such working capital, they’re speculative investments. Let’s say you approach a merchant cash advance provider, such as Knight Capital Funding, for working capital. This provider will ask you for several months’ business bank statements and a few other pieces of information to verify your banking information and identity and determine whether your business will likely be able to generate the future receivables.

Providers of merchant cash advances come to this determination based on identifiable trends within the business’ past and industry.

What industry is the business in?

Is the business profitable?

Has the business experienced serious financial hardships?

Is the business over-leveraged?

After answering each of these questions and others, merchant cash advance providers determine whether the merchant will likely generate the future revenue and the purchased future receivables.

Merchant Cash Advances Use Factor Rates

Unlike percentages, which are commonly used for loans, factor rates are decimal figures that generally vary from provider to provider. Factor rates are merchant cash advance providers way of charging merchants for the risks associated with the merchants’ likelihood of generating the future receivables.

Merchant Cash Advances are Not Loans

It’s important to understand the distinction between a merchant cash advance and a loan. Merchant cash advances are not loans. The two are very different. As described above, a merchant cash advance is the acquisition of a contractually specified percentage of your future receivables in exchange for an upfront lump-sum payment. Merchant cash advance providers expect the funds to be remitted on a flexible schedule based on the amount of money remitted each day along the way, generally referred to as a ‘turn,’ along with a factor rate of x (e.g., 1.4) for administrative and other fees. Merchant cash advance remittances are generally made to the provider daily or weekly via an ACH withdrawal, with amounts varying based on the revenue generated by the business. The amount varies because merchant cash advance providers purchase a percentage of your receivables up to a specified dollar amount, not guaranteed remittances of $y daily.

Loans, on the other hand, are a bit different. In fact, loans are almost the opposite of merchant cash advances. The loan process usually begins with a lengthy look at both you as a merchant and as an individual. Loan officers require several detailed financial documents. For example, loans require you to have been in business for several years and rely heavily on your personal credit history. Once approved for a loan, you receive a specified amount of money for a set term with $y to be remitted to the loan issuer monthly. With a loan, you’re borrowing someone else’s money to achieve your goals. Loans, on their own, do not entitle the issuer to any percentage of your future receivables. Loans carry with them an absolute right of repayment.

What’s Better, Merchant Cash Advance or Loan?

It depends. There’s no correct answer to this question because it’s wholly subjective from situation to situation. The simple answer would be as follows: whichever source of funds best enables you to achieve your short-term goals without deviating from your long-term goals.

Let’s dig a bit deeper and see if we can come to a more definitive determination.

Merchant cash advances are great for business owners to obtain the cash they need in a quick and efficient manner. Some providers, Knight Capital Funding included, can provide small business owners with working capital within 24 hours. The speed with which small business owners can obtain large amounts of cash (Knight Capital Funding offers up to $250,000) makes it an attractive option for situations where a key piece of equipment breaks, or a time-sensitive business opportunity requires immediate action. Loans, on the other hand, are good for small business owners who have both the documentation necessary to obtain the loan and the time to go through the loan process.

How do you come to a decision that’s right for you and your business?

Determining the best source for your business’ next cash infusion should be considered on a case-by-case basis. At each point, your business will likely have different needs and the options you consider should be determined on where your business is at that point in time. However, you should ask yourself the following questions:

First, start by writing down what you need the funds for and whether such expenses are necessary.

Second, ask yourself if your business meets the requirements to receive a loan. If not, a merchant cash advance or another source of alternative funding might be right for your business.

Third, determine whether your business will likely generate the purchased future receivables.

Fourth, research merchant cash advance providers and loan issuers.

Fifth, develop a list of questions and ask for clarification from provider and issuer customer support teams.

Sixth, apply for a merchant cash advance or loan with the provider or issuer you think can best meet your needs.

Seventh, spend the funds wisely.

There was a time when small businesses would find themselves in a bind. They needed funds to grow and in order to get a loan from traditional banks they would need cash or collateral to get the money for their expansion. This would stunt their growth. Thanks to online lenders this is a problem of the past.

The economic impact of this lending activity can no longer be ignored. According to a study based on data collected from 2015 to 2017 and conducted by NDP Analytics the five major online lenders were responsible for the following:

Funding nearly $10 billion to approximately 180,000 small businesses, one-quarter of which were considered microbusinesses with annual sales of less than $100,000.

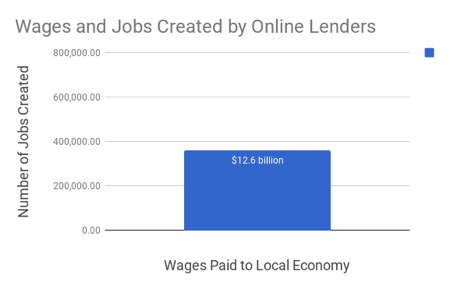

Generating $23.0 billion in sales for the business borrowers. The additional sales of these small businesses in turn generated $37.7 billion in gross output and created 358,911 jobs with $12.6 billion wages in the local economies of the small business borrowers.

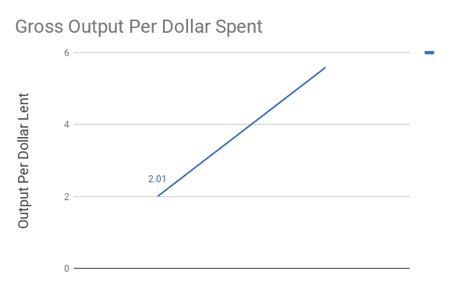

For every one dollar in lending to small businesses, sales of small business borrowers increased between $1.05 and $2.84 (with an average of $2.31). That one dollar in lending created between $2.01 and $5.59 (with an average of $3.79) in gross output in the local communities of the small business borrowers.

Small Businesses

Small businesses make up the backbone of the U.S. economy accounting for more than 99% of all U.S. firms and employ over half of all workers. They are also the main sources of new job creation for Americans. Their existence and survival relies heavily on the availability of funds and those that have less than $1 million in annual revenue find that the credit gap is one of their top challenges.

Small businesses need funds the most when they are hardest to get, when the economy tanks. In addition, getting a loan from a traditional bank can become a cumbersome and lengthy process. Borrowers may spend up to 26 hours searching and applying for loans and then have to wait for a decision and disbursement.

Online Lending Fills the Financing Gap for Small Businesses

Online lending, like Knight Capital Funding, has become a popular financing source for small businesses across industries. Traditional financial institutions and online small business lenders are partnering to offer smaller loan amounts and shorter-term loans to business owners. While some borrowers can obtain funding from traditional banks, many online lending customers do not have access to such traditional loans because of low personal credit scores and/or a lack of collateral assets. Although the associated costs of borrowing can be higher with online lenders, small business borrowers may be willing to pay a higher price in exchange for an easy application process, a quick decision, and rapid availability of funds, or because they have no alternative sources of borrowing.

Generally speaking, five distinguishing characteristics of online lenders are:

- They provide credit to borrowers very quickly, sometimes within hours;

- They offer smaller loans with shorter terms;

- They use automated online loan applications and have no retail branches;

- They rely on a variety of funding sources including institutional investors, hedge funds, individual investors, venture capital, and depository institutions; and

- They use electronic data sources and technology-enabled underwriting models to automate processes and credit risk assessment.

Economic Benefits

While there are still many online lenders that take the business owner’s personal credit score (FICO®) into consideration, not all of them do. This is good to know considering that roughly 18% of principal business owners have FICO scores of less than 600. Knight Capital Funding uses their own proprietary credit scoring system that is based on the businesses financial health, not the individual.

In conclusion, the impact that online lending has on local economies extends way beyond small businesses maintaining or expanding operations. In order to truly understand the effects of these activities we need to look at the wages and jobs created by online lenders as well as the gross output in these communities. With so many benefiting from lending companies that are filling the financial gap for small businesses, it’s no wonder these lenders are growing faster and faster every day.

Metlife and the U.S. Chamber of Commerce recently released the Small Business Index for the second quarter of 2018. The Small Business Index is a survey that the U.S. Chamber of Commerce and Metlife conducts to check the health and mood of small businesses. For the fifth quarter in a row the index climbed to 68.7, indicating new heights of optimism for small business owners. Business owners work almost double the amount of hours as the typical American worker yet for the most part they are happy with their choice.

Etienne Gillard, CEO of Waleteros says, “Entrepreneurship is not for the faint at heart. I work 18 hours a day and I love it – this is my life. I wake up knowing that I am more than a good dad, good husband, and good friend…. I want to make a solution that is helping millions of people in their daily lives. I want to build the best product that can attend to the financial needs of people, and I won’t stop.”

Technology Helps Lead the Pack

For small businesses it seems technological adoption appears to be linked to stronger outcomes and increased confidence. Small businesses that reported being ahead of the pack when it comes to technology (32%) showed they were in good health while those that admitted feeling that they were behind were also less positive about their overall business health. Businesses that also reported being ahead of the rest technologically were also more likely to report increasing staff.

Local Economic Outlook Is Key

Although the national economic outlook remains positive, it is lower than the first quarter, especially in the south where it dropped 19%. Nevertheless, local economic health is the primary means of measuring the experiences of small businesses and overall, businesses across the country showed increased confidence over last quarter.

Tom Sullivan, Vice President of Small Business Policy for the U.S. Chamber of Commerce says, “Five straight quarters of business optimism shows that small business owners feel the wind at their back and not in their faces, but there is still plenty of work to do. When I’m traveling the country and meeting with small business owners, they’re expressing concerns around general national economic uncertainty and persistent workforce challenges. These are two issues we see across the board at the Chamber and could be affecting small business owners’ national economic sentiment.”

A majority of small business owners expect higher earnings for the fourth quarter in a row, with 62% anticipating an increase in revenue one year from now and 32% of small businesses anticipate increasing staff.

With so much optimism, business owners seem to be ready to expand, hire more personnel and perhaps even begin looking for new ways to fund their growth.

Traditionally, businesses looking for money would consider a Merchant Cash Advance (MCA) as a last choice. This is because this type of funding has had a reputation for high fees that would be the only option for borrowers with poor credit histories.

As different forms of alternative lending become familiar, competition has increased in the industry as well as the attention it has garnered which has led to increasingly high industry standards.

This has resulted in a shift in the industry that has led to rates that are competitive with traditional banks but have the advantage of an MCA. They can fund merchants quickly and don’t require collateral. At the time of this writing Knight Capital Funding offers a 1.15 rate with a soft credit pull for its “Platinum Plus” deals. This is a real indicator of where the industry is going.

This change hasn’t gone unnoticed. Many small businesses are starting to view MCAs in a positive light. This shift in the industry, along with a noticeable increase among businesses on how they perceive Merchant Cash Advance companies has led to a large interest from investors as well. Credit Suisse has recently invested over $300 million in companies that offer alternative lending.

Companies that offer alternative lending are very different than your standard brick and mortar banks. As a matter of fact, many categorize themselves as “fin-tech” companies. This proves that one of the driving forces in how the alternative lending industry has changed its image is in how it has adapted to technology and innovation. MCAs are constantly using technology to make the application process seamless and less confrontational.

A great example of this is Knight Capital Funding which uses Machine Learning to help underwrite who it funds. By doing so, Knight Capital Funding has been able to help reduce the default rate and find fraud faster and more accurately. This has led to increased savings which are then passed on to merchants and partners. In addition, they are using advanced data science techniques and automation to make the application and funding process faster and easier.

Companies that offer alternative funding have begun making innovative strides that are not only beginning to draw attention to them but also peak the interest of investors and make merchants see them in a different light. Everyone is beginning to see that alternative funding is the future of business funding.

There is an epidemic taking place regarding New Year’s Resolutions – people aren’t doing them. You may be able to identify. The theory behind this decision is based on the fact that most people fail to follow through. But, not setting resolutions or goals is just ignoring the problem. The New Year is in full swing already, but if you haven’t made resolutions it’s not too late. Here are 4 steps to help you follow through on your resolutions for the year.

1. Start by setting SMART goals

There is a lot out there about setting SMART goals, but most people still aren’t doing it right. To set a SMART goal it needs to be Specific, Measurable, Achievable, Reasonable, and Time-bound. For example, if you want to grow your business you might set a goal to increase your revenue in 2018. However, this goal is impossible to track, therefore making it impossible to follow through on. How do you know if you have achieved it or not? If you increase by just $1 is that going to be what you are looking for?

On the other hand, if you make this a SMART goal it might look something more like: Increase sales revenue by 5% within the first six months of 2018. Is this specific? Yes, it states what the goal exactly. Is it measurable? Yes, since you know you are looking for a 5% increase you can calculate exactly what that dollar amount should be if you hit your goal. Is it achievable and reasonable? Yes, this is a realistic goal. Is it time-bound? Yes, you know that you have until the last day of June to hit your goal.

2. Break it into small goals

Your SMART goal does nothing for you if you fail to make a plan to accomplish it. Take the example above about increasing revenue by 5%. How are you going to increase your revenue? If you don’t make a plan you are destined to fail. But, if you carefully think through creating a plan on how to get there you will make progress.

Break your resolution up into bite-size pieces. If your goal is to grow your business by 5% in 6 months then determine how much you want to grow every month leading up to the deadline. These smaller goals will keep you propelling forward to your bigger resolution.

3. Determine how to get there

Choosing a resolution is really only the first step, and it is by far the easiest. Once you have your resolution broken down into smaller goals it’s time to determine what tasks you need to complete in order to accomplish the goal. From our example above, what types of things do you need to do in order to increase your revenue? Here are a few examples:

- Begin SMS marketing campaign to reach your customers faster

- Restructure website to begin selling more online

- Hire additional staff

- Look for new add-ons to offer customers

4. Monitor your progress

The majority of people choose not to set goals and resolutions because they don’t want to fail. However, doing this holds them back from the progress that they could be making. Other people choose to set resolutions, but then as soon as they start to fail or have problems moving forward they quit. That way when they fail it is because they “weren’t really trying” instead of feeling like they failed.

Don’t let the fear of failure hold you back from making resolutions and working to accomplish them. Once you start working towards your goals you should spend a few minutes at the end of every week evaluating if you made progress. Take time to look and see where you succeeded and where you failed during the week. Then, look at the failures and determine what changes you need to make to start succeeding in those areas in the coming weeks.

Remember to include your staff in the process. Even if you establish the resolution you want your staff to be aware of the goals and what their role is in reaching them. If you stick to this plan you will find yourself making progress towards your business goals week after week.

2018 is here and it’s time to shake things up. Your business and employees can easily become stagnant. So, use this year to start trying new things and finding ways to improve your office. Here are a four ideas to get the juices flowing.

1. Learn what motivates your staff

If you still assume that your staff is motivated by cash bonuses you could be way off. Many studies have found that employees are motivated by a number of items other than additional pay. In fact, many employees would choose another reward if it were up to them. Here are some of the things that employees are motivated by:

- Paid time off. Provide ways for your employees to earn additional paid time off of work, or simply reward them with it if they have been working hard and putting in extra hours.

- Praise them more. Believe it or not some employees just want to be praised and recognized. Take the time to praise them and let them know how much you appreciate their work both privately and in front of others.

- Listen to their ideas. When a company asks for and listens to the opinions and advice of all employees it motivates employees to look at their job in a new way.

- Build a team environment. If you want your employees to be motivated and love their jobs then you need to build a team environment. Provide time for team building activities together and look for ways to add fun to the day, like Taco Tuesday.

2. Add a little fun

Business owners have a lot of stress; you can relate to that. There are so many things that you have going on each day. There are bills waiting to be paid, customers waiting for callbacks, and a long list of unread emails growing in your inbox. It’s easy to allow that stress to build and then take it out on your employees. In order to combat this, you need to add a little fun to the office.

There are many ways that you can accomplish this, but here are a few ideas that are favorites among employees at other organizations:

- Casual Friday. It sounds simple enough, but if your office has a dress code consider allowing your employees to have a casual Friday, even just once a month. It’s amazing what this does for your individual employees, the mood of the office, and the level of creativity that takes place.

- Send around or post a daily joke. Keep it clean and stay away from topics like government so you don’t risk offending anyone or starting a fight. Find a way to make your employees smile.

- Have an office pet. Studies have found that offices with a dog are more productive and the employees are happier. A good option would be a hypoallergenic dog so it will be ok for people with allergies and asthma.

- Celebrate the wins together. Did you close a big deal? Or, did you get a great deal on a product from a vendor? Celebrate with the whole staff together. And, make sure to celebrate the small things. If you feel that the office mood has been on a downward spiral throw a rootbeer float party to celebrate making it through Monday.

3. Cut down on emails

Emails take up way too much time. Between typing out what you are trying to say, and then retyping to make sure that it comes across the right way, to reading and responding to everything that comes in your whole day can be wasted. Picking up the phone and calling someone is more time efficient than email. Many times you will also be able to get a faster answer and move on to another task sooner.

Switch up 2018 and require that your employees begin calling each other instead of emailing. If documents need to be referenced in the conversation they can be sent prior to the phone call. This is a good way to get your employees to interact with each other, take a break from the screen, and waste less time. You will most likely find that you start to use this tactic with your customers and vendors as well because it is so much more efficient.

4. Think outside of the box

Spend some time as a staff thinking of the processes that you have in place, even the ones that have been set for years. Think about why you do them that way and ask for ideas on how to do them differently. Ask the employees for ideas on how to save time and money at work. The people that are doing the jobs on a daily basis are usually the ones that are going to know how to make the process better, yet many business owners never ask them.

Encourage employees to participate in this process by rewarding their efforts. Reward anyone that comes up with a money saving idea a gift card or other treat for making their suggestion and contributing to the company.

Don’t allow 2018 to pass you by without making some bold moves to grow your business. This is your year to try new things and find wild success in places you never would have guessed.

When it comes to business, time is money. That means you want your entire team working as efficiently as possible. Less time is wasted and more deals can be closed when the team is efficient. Habits and routines play a major role in the way a day in the office goes. A few simple changes can help you and your employees work more efficiently. Try adding the following:

Start with goals

It’s impossible to know if your team is achieving goals if you don’t have any. This is a multi-step process that you need to work through in order to become more efficient in this area. It starts at the top. Upper management needs to come together to establish the goals for the company as a whole. Once this has been accomplished the process needs to filter down. Each department and team member needs to know what the goals are so they know what they need to achieve in order to do their part to reach the larger goal.

Touch base often

Everyone will work more efficiently when clear goals are set because they know exactly where their efforts are supposed to go. You need to create regular times for team members to check in with each other to keep the momentum rolling. Have a weekly meeting with the sales team, where they share their successes and struggles from the week. They can ask for additional resources if they need or find someone to collaborate with. However, keep these meetings short in order to keep efficiency high. Meetings are one of the biggest killers of productivity when done incorrectly.

Begin with a plan in place

Spend the first few minutes of the workday looking over your daily plan. The plan is one that was created at the end of the previous day. By doing this you do not forget about any important tasks that need to be completed. The next day you can come right into the office and start working on the specific items that need your attention. If everyone in the office operates in this manner it will help your entire team be more efficient.

Track successes with each other

Create the habit of celebrating wins together. This will foster a positive environment within your office. Establish a routine that the team is to follow when they experience a success. It could be a great prospect they secured information for, a deal they closed, or a feel-good story they heard about from an existing client. Have a system in place for how the successes should be shared and celebrated. Happy workers are more efficient workers and everyone loves to have their work acknowledged.

Spend a week tracking time

It might seem like a waste of time to have each person track their time, but it will pay off in the end. If everyone tracks the time they spend on each task for a week they will begin to see areas that they can become more efficient in. This could include reducing the amount of time they check and respond to their email to only a few times a day, or adding an extra printer to keep people from needing to walk as far. Every time you interrupt your workflow it takes time to get back into it.

Start the day with a 5-minute meeting

Start the day with a 5-minute meeting. If you pull your entire staff together at the start of the day you can accomplish a few things:

- It allows you to see who is showing up on time.

- You can get a quick status update on the big deals.

- Share a motivational quote or sales tip.

- Employees will show up early so they aren’t late and they will spend those few minutes catching up. They can then get right to work when the meeting is finished.

- Find out who needs additional resources to close a deal.

In the end, the two things that will help improve employee efficiency the most include keeping employee morale high and having the right processes in place. There are small changes you can make overnight, but it takes time to see significant changes. Stick with the process, include your staff by asking for ideas, and you will see your employees being more efficient on a daily basis.