There was a time when small businesses would find themselves in a bind. They needed funds to grow and in order to get a loan from traditional banks they would need cash or collateral to get the money for their expansion. This would stunt their growth. Thanks to online lenders this is a problem of the past.

The economic impact of this lending activity can no longer be ignored. According to a study based on data collected from 2015 to 2017 and conducted by NDP Analytics the five major online lenders were responsible for the following:

Funding nearly $10 billion to approximately 180,000 small businesses, one-quarter of which were considered microbusinesses with annual sales of less than $100,000.

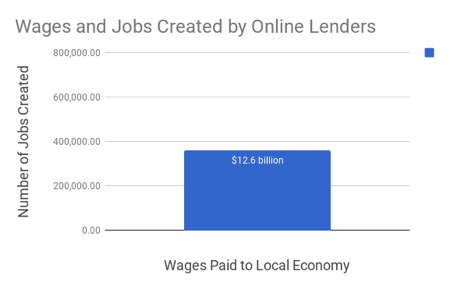

Generating $23.0 billion in sales for the business borrowers. The additional sales of these small businesses in turn generated $37.7 billion in gross output and created 358,911 jobs with $12.6 billion wages in the local economies of the small business borrowers.

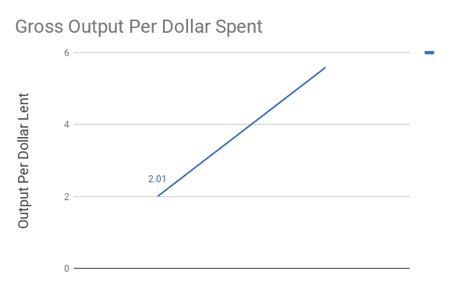

For every one dollar in lending to small businesses, sales of small business borrowers increased between $1.05 and $2.84 (with an average of $2.31). That one dollar in lending created between $2.01 and $5.59 (with an average of $3.79) in gross output in the local communities of the small business borrowers.

Small Businesses

Small businesses make up the backbone of the U.S. economy accounting for more than 99% of all U.S. firms and employ over half of all workers. They are also the main sources of new job creation for Americans. Their existence and survival relies heavily on the availability of funds and those that have less than $1 million in annual revenue find that the credit gap is one of their top challenges.

Small businesses need funds the most when they are hardest to get, when the economy tanks. In addition, getting a loan from a traditional bank can become a cumbersome and lengthy process. Borrowers may spend up to 26 hours searching and applying for loans and then have to wait for a decision and disbursement.

Online Lending Fills the Financing Gap for Small Businesses

Online lending, like Knight Capital Funding, has become a popular financing source for small businesses across industries. Traditional financial institutions and online small business lenders are partnering to offer smaller loan amounts and shorter-term loans to business owners. While some borrowers can obtain funding from traditional banks, many online lending customers do not have access to such traditional loans because of low personal credit scores and/or a lack of collateral assets. Although the associated costs of borrowing can be higher with online lenders, small business borrowers may be willing to pay a higher price in exchange for an easy application process, a quick decision, and rapid availability of funds, or because they have no alternative sources of borrowing.

Generally speaking, five distinguishing characteristics of online lenders are:

- They provide credit to borrowers very quickly, sometimes within hours;

- They offer smaller loans with shorter terms;

- They use automated online loan applications and have no retail branches;

- They rely on a variety of funding sources including institutional investors, hedge funds, individual investors, venture capital, and depository institutions; and

- They use electronic data sources and technology-enabled underwriting models to automate processes and credit risk assessment.

Economic Benefits

While there are still many online lenders that take the business owner’s personal credit score (FICO®) into consideration, not all of them do. This is good to know considering that roughly 18% of principal business owners have FICO scores of less than 600. Knight Capital Funding uses their own proprietary credit scoring system that is based on the businesses financial health, not the individual.

In conclusion, the impact that online lending has on local economies extends way beyond small businesses maintaining or expanding operations. In order to truly understand the effects of these activities we need to look at the wages and jobs created by online lenders as well as the gross output in these communities. With so many benefiting from lending companies that are filling the financial gap for small businesses, it’s no wonder these lenders are growing faster and faster every day.

Metlife and the U.S. Chamber of Commerce recently released the Small Business Index for the second quarter of 2018. The Small Business Index is a survey that the U.S. Chamber of Commerce and Metlife conducts to check the health and mood of small businesses. For the fifth quarter in a row the index climbed to 68.7, indicating new heights of optimism for small business owners. Business owners work almost double the amount of hours as the typical American worker yet for the most part they are happy with their choice.

Etienne Gillard, CEO of Waleteros says, “Entrepreneurship is not for the faint at heart. I work 18 hours a day and I love it – this is my life. I wake up knowing that I am more than a good dad, good husband, and good friend…. I want to make a solution that is helping millions of people in their daily lives. I want to build the best product that can attend to the financial needs of people, and I won’t stop.”

Technology Helps Lead the Pack

For small businesses it seems technological adoption appears to be linked to stronger outcomes and increased confidence. Small businesses that reported being ahead of the pack when it comes to technology (32%) showed they were in good health while those that admitted feeling that they were behind were also less positive about their overall business health. Businesses that also reported being ahead of the rest technologically were also more likely to report increasing staff.

Local Economic Outlook Is Key

Although the national economic outlook remains positive, it is lower than the first quarter, especially in the south where it dropped 19%. Nevertheless, local economic health is the primary means of measuring the experiences of small businesses and overall, businesses across the country showed increased confidence over last quarter.

Tom Sullivan, Vice President of Small Business Policy for the U.S. Chamber of Commerce says, “Five straight quarters of business optimism shows that small business owners feel the wind at their back and not in their faces, but there is still plenty of work to do. When I’m traveling the country and meeting with small business owners, they’re expressing concerns around general national economic uncertainty and persistent workforce challenges. These are two issues we see across the board at the Chamber and could be affecting small business owners’ national economic sentiment.”

A majority of small business owners expect higher earnings for the fourth quarter in a row, with 62% anticipating an increase in revenue one year from now and 32% of small businesses anticipate increasing staff.

With so much optimism, business owners seem to be ready to expand, hire more personnel and perhaps even begin looking for new ways to fund their growth.

Traditionally, businesses looking for money would consider a Merchant Cash Advance (MCA) as a last choice. This is because this type of funding has had a reputation for high fees that would be the only option for borrowers with poor credit histories.

As different forms of alternative lending become familiar, competition has increased in the industry as well as the attention it has garnered which has led to increasingly high industry standards.

This has resulted in a shift in the industry that has led to rates that are competitive with traditional banks but have the advantage of an MCA. They can fund merchants quickly and don’t require collateral. At the time of this writing Knight Capital Funding offers a 1.15 rate with a soft credit pull for its “Platinum Plus” deals. This is a real indicator of where the industry is going.

This change hasn’t gone unnoticed. Many small businesses are starting to view MCAs in a positive light. This shift in the industry, along with a noticeable increase among businesses on how they perceive Merchant Cash Advance companies has led to a large interest from investors as well. Credit Suisse has recently invested over $300 million in companies that offer alternative lending.

Companies that offer alternative lending are very different than your standard brick and mortar banks. As a matter of fact, many categorize themselves as “fin-tech” companies. This proves that one of the driving forces in how the alternative lending industry has changed its image is in how it has adapted to technology and innovation. MCAs are constantly using technology to make the application process seamless and less confrontational.

A great example of this is Knight Capital Funding which uses Machine Learning to help underwrite who it funds. By doing so, Knight Capital Funding has been able to help reduce the default rate and find fraud faster and more accurately. This has led to increased savings which are then passed on to merchants and partners. In addition, they are using advanced data science techniques and automation to make the application and funding process faster and easier.

Companies that offer alternative funding have begun making innovative strides that are not only beginning to draw attention to them but also peak the interest of investors and make merchants see them in a different light. Everyone is beginning to see that alternative funding is the future of business funding.

When it comes to business, time is money. That means you want your entire team working as efficiently as possible. Less time is wasted and more deals can be closed when the team is efficient. Habits and routines play a major role in the way a day in the office goes. A few simple changes can help you and your employees work more efficiently. Try adding the following:

Start with goals

It’s impossible to know if your team is achieving goals if you don’t have any. This is a multi-step process that you need to work through in order to become more efficient in this area. It starts at the top. Upper management needs to come together to establish the goals for the company as a whole. Once this has been accomplished the process needs to filter down. Each department and team member needs to know what the goals are so they know what they need to achieve in order to do their part to reach the larger goal.

Touch base often

Everyone will work more efficiently when clear goals are set because they know exactly where their efforts are supposed to go. You need to create regular times for team members to check in with each other to keep the momentum rolling. Have a weekly meeting with the sales team, where they share their successes and struggles from the week. They can ask for additional resources if they need or find someone to collaborate with. However, keep these meetings short in order to keep efficiency high. Meetings are one of the biggest killers of productivity when done incorrectly.

Begin with a plan in place

Spend the first few minutes of the workday looking over your daily plan. The plan is one that was created at the end of the previous day. By doing this you do not forget about any important tasks that need to be completed. The next day you can come right into the office and start working on the specific items that need your attention. If everyone in the office operates in this manner it will help your entire team be more efficient.

Track successes with each other

Create the habit of celebrating wins together. This will foster a positive environment within your office. Establish a routine that the team is to follow when they experience a success. It could be a great prospect they secured information for, a deal they closed, or a feel-good story they heard about from an existing client. Have a system in place for how the successes should be shared and celebrated. Happy workers are more efficient workers and everyone loves to have their work acknowledged.

Spend a week tracking time

It might seem like a waste of time to have each person track their time, but it will pay off in the end. If everyone tracks the time they spend on each task for a week they will begin to see areas that they can become more efficient in. This could include reducing the amount of time they check and respond to their email to only a few times a day, or adding an extra printer to keep people from needing to walk as far. Every time you interrupt your workflow it takes time to get back into it.

Start the day with a 5-minute meeting

Start the day with a 5-minute meeting. If you pull your entire staff together at the start of the day you can accomplish a few things:

- It allows you to see who is showing up on time.

- You can get a quick status update on the big deals.

- Share a motivational quote or sales tip.

- Employees will show up early so they aren’t late and they will spend those few minutes catching up. They can then get right to work when the meeting is finished.

- Find out who needs additional resources to close a deal.

In the end, the two things that will help improve employee efficiency the most include keeping employee morale high and having the right processes in place. There are small changes you can make overnight, but it takes time to see significant changes. Stick with the process, include your staff by asking for ideas, and you will see your employees being more efficient on a daily basis.

It’s a New Year. Therefore it is a chance for new goals and to realize new successes. However, the majority of people go wild setting resolutions at the start of the new year only to find they have forgotten what they wanted to accomplish by the time February rolls around. If you want to make 2018 the year you actually achieve your New Year’s resolutions, do the following:

Change your thinking

First, you need to change the way you think about resolutions. There is something about the word that makes it harder for people to follow through on accomplishing them. We tend to think of “resolutions” as all or nothing. That means the first time we start to struggle with following through on them we usually quit. And, if we fail to accomplish them at the end of the year, we feel like failures. On the other hand, if we set goals and don’t meet them we still see our progress of working towards them. We can continue working on them throughout the year.

Most people set very generic resolutions that can be hard to stick to instead of setting specific goals. For example, a resolution might be to get healthier in 2018, but what does that mean? How do you know if you did or not? On the other hand, a goal might be to lose 30 pounds in 2018. The first time you skip exercising and eat junk food you will not have already failed on your goal, but you might feel like you did on the resolution.

Bottom line: Set goals, not resolutions.

Set limits and stick to what matters

People tend to want to harness the power of the fresh start that the New Year brings. So, they go overboard and set too many goals. They end up with a long list of goals that no person can honestly accomplish in one year. Limit your goals to only 3-4 goals for the year. Make sure each goal is important to you. If you understand the real reason you want to accomplish a goal it will help you stick to it during the tough time and obstacles.

For example: Instead of just setting a goal on how many clients you want to help fund before the end of the year, think about the why behind it. What’s motivating you to set that goal? Is it so you can increase your revenue? Is it so you can help other small businesses succeed? Knowing your “why” can help you stay motivated.

Bottom line: Set 3 or 4 goals that are important to you.

Make your goals SMART

The idea of SMART goal setting is not new, but many people still fail to do it. In order for your goals to be achievable they need to be SMART:

- Specific – Instead of “increase clientele” it should be “increase clientele by x%”. You need to include the details of what you are really trying to accomplish.

- Measurable – By setting the x% above you are able to have a way to measure your level of success. You can easily calculate at any time to see if you are making progress.

- Attainable – You might want to see your business revenue double this year, but unless you have only grown 5% the past five years, it most likely is not possible. Do not set goals that you have no way of accomplishing because you are only setting yourself up for failure.

- Relevant – Before setting goals you need to know what direction you want your business and life to move in. Any goal you set should be helping you move in that direction.

- Time-bound – Deadlines matter when it comes to goal setting. Don’t make the end of December your deadline for all your goals. Or, if you do make sure you are breaking it down into smaller goals that you are hitting throughout the year to keep yourself moving forward.

Bottom line: Make each goal SMART

Create a plan

So, you have your goals. You limited the number of them and made sure they were SMART, now what? You need to create a plan of attack. How are you going to accomplish those goals? Your first step is to break each goal down into smaller goals that can be spread throughout the year. If you want to increase your clientele by x% then what percentage do you need to be at by the end of the first quarter and the second? These smaller goals make your large goal achievable because you are always making progress towards them.

Without a plan, you will get to the end of 2018, in the blink of an eye, and realize that you have not made purpose effort to reach your goal.

Bottom line: Break your goals down into smaller goals for each quarter.

Set an appointment with yourself

Now it’s time to put your goals on your calendar. Reserve time to purposefully work on your goals. Set aside 15 minutes every week to check on your progress. During this time you can see where things are going well and which areas need improvement. Ask yourself what is working and where you are failing? Then, don’t be afraid of the failures, instead acknowledge them and look for a way to address them. The key to reaching your goals is to be purposeful, so actually block this time off your calendar. Also, block of time at the end of each month for you to look over the month as a whole and to plan for the next one.

Bottom line: Check in with yourself throughout the year to review your progress.

2017 was over before we knew it, and 2018 is bound to do the same. Spend some time with yourself today working through these steps so you can achieve your goals in the new year.

The end of the year will be here before you know it and with it comes the setting of new resolutions and goals for 2018. Many people find they have a little time off around the holidays. Although you probably have plenty of holiday parties and family get-togethers to attend, it can be a great time to sneak in a little reading. Here are 8 books worth reading.

1. The 10X Rule

Grant Cardone’s book The 10X Rule explains that to achieve higher results in your life you need to raise your level of thinking. The entire book is designed to help you increase the way you think. There are exercises at the end of every chapter that you work through in order to put it into practice. This book can change the way you look at your entire life, from growing your sales to improving your personal life. You will overcome the limits that you subconsciously set in your mind.

2. How to Win Friends & Influence People

If you haven’t read this book by Dale Carnegie yet, it’s time. The book has been around since the 1930’s and the information within it is as valuable today as it was back then. The key to making sales and growing a business is being personable and forming good relationships with people. It helps you in networking, in dealing with customers, and in your personal relationships. Any book that has stood the test of time and is still so highly recommended is worth reading.

3. Think and Grow Rich

Here is another book that is 80 years old and still growing strong. Napoleon Hill wrote this book only a year after How to Win Friends & Influence People was released. Think and Grow Rich is a motivational and self-help book. It will help you determine how to establish a plan to make all the changes that you want in your personal and business career going into the new year. Even though this book is older the information is still valid and can be used with today’s business practices as well.

4. The Ultimate Sales Machine

Chet Holmes wants to help you get your focus to grow your business. His book The Ultimate Sales Machine teaches 12 key strategies that you need to focus on. He simplifies the process to help you focus on the areas that will have the biggest payoff. If you are ready and determined to grow this is the book for you.

5. Conversations That Win The Complex Sale

Erik Peterson and Tim Reisterer have been working for over 20 years to perfect this sales process. In Conversations That Win the Complex Sale you will learn how to make the sale by telling your prospect their own story of success instead of focusing on yourself. This book will help you separate yourself from the crowd and your competition. If you want to learn how to close the sale without a long list of boring statistics that prospects don’t care about, you need to read this book. You will learn how to speak about what your prospect cares about.

6. The Lost Art of Closing

Anthony Iannarino teaches how to take the pain and awkwardness out of the closing the sale. People don’t like being sold to which makes closing a business deal difficult. However, the book The Lost Art of Closing shows you the right way to approach closing. You will learn a new process of leading prospects through your steps that work to remove the delay in making a purchase.

7. The 7 Habits of Highly Effective People

Stephen Covey shares the secrets that successful people use in order to achieve their level of success. The book The 7 Habits of Highly Effective People will help you get your focus in the right place. If you follow the principals that the book teaches you will see an improvement in your personal and business life. While some of the concepts are simple and basic they are the common things that most people are failing to do in order to find success.

8. Hack Your Habits

Are you ready to make powerful changes in your life, but lack the willpower and motivation to accomplish it? This book is for you. Hack Your Habits by Joanna Jast teaches steps to reach your goal that doesn’t require pure willpower to ge the job done. This book is for every person that has set goals over and over and found after a few days they lacked the motivation and determination to continue. If you lack self-control and struggle to create the right habits, this book is for you. It teaches you how to reduce the impact of the temptations that typically get you off course.

If you don’t have a lot of time to read you can still get started. Choose the book that speaks to your current situation the most. And, most importantly, make sure you implement the new ideas you are learning through your reading.

Are you ready for the holidays? Are the gifts purchased and ready to hand out to your employees before the holiday break? If you haven’t even started yet, you are not alone. Many shoppers procrastinate. And, for many it isn’t because they don’t want to purchase the gift, they just don’t know what to buy. It’s hard enough when you are buying for people you know personally, but times it by ten when you are choosing gifts for your employees.

This can be the year you get ahead on your gift giving. Use these tips to choose holiday gifts your employees will actually want to receive.

Everyone loves cash

It will be hard for you to find an employee that doesn’t love receiving cash. It’s an easy way to give your staff something that every person will use. And, since they can choose what they spend it on you know it will either be something that they really needed or that they want. However, there are some reasons you might not want to hand cash out for the holidays, and the main one is lack of it in the first place. It’s one thing if your employees is able to open an envelope with a few hundred dollar bills in it. But, it doesn’t hold the same excitement when the envelope has a single twenty in it. Then, it’s better to go with purchasing a gift.

Give an experience

People are overloaded with stuff and they don’t always need or want more of it. So instead, offer them an experience. This can be tailored to the staff that you have. If you have a lot of employees with young children consider throwing a holiday party at the zoo. Your employees can spend time with their families seeing the animals and you can kick it off with a meal with your entire group together. There is nothing that people love as much as their families so when you include them in the holiday party your employees will truly appreciate it. This also helps your team grow closer as they get to connect on a more personal level outside of work.

If you want to keep it to just employees take everyone to an Escape Room. Your employees can try to beat the clock, or each other if you are split into groups. When everyone has finished, take them out to lunch or for a drink.

Or, give them a gift certificate so they can have an experience with the people of their choosing. If you are completely honest you know that your employees don’t always like the idea of hanging out with coworkers when they could be with their family or friends. In this case, you can provide them a gift certificate to dinner and a movie and allow them to go with the people that are special in their life.

Give them something they will use

People love getting consumables because they don’t have unlimited space to store more items. Do not give your employees a gift with the company logo on it. Do not give them a coffee mug, paperweight, or any other promotional type item. If you are struggling to think of a gift, go with something that they can consume. If you know they are wine drinkers you can buy them a bottle of wine. Or, follow suit with other companies that provide each employee with a Christmas ham, steak, or prime rib. These are nice touches that you turn into a company tradition and do every year. It makes it easy for you and will become something that your employees look forward to receiving.

Personalize it

If you have a small staff consider personalizing the gifts to each person. Stick to the same budget for each employee, or based upon their position and status in the company. In order to pull this off successfully, you will need to know your employees so you can choose something that you know they have been wanting or something they will love. While this tends to be more time consuming it will also be appreciated by each member of your staff.

Choosing gifts does not need to be a stressful process. However, if you wait until the last minute it will definitely increase your stress level. Start early to make your process smooth and to assure you have gifts for your staff before the holiday arrives.

Sales can be a tricky thing to navigate as a team. You want to work towards company goals together, but there is a level of competition among those working in the department together. It is common to see a leaderboard up in the break room or conference room so everyone can easily track who has the most sales so far in the month. While this seems like it would be a good way to motivate each person to try harder, it is not the best way to improve sales as a team. If you are ready to improve your business as a whole, make these changes in your sales team:

-

Set SMART goals

Goal setting needs to happen at three different levels within a sales team.

- From the top – The first goal that needs to be established is from the very top of the company, the business owner or CEO. There should be big picture goals that the company is working towards.

- At the department level – Once the sales team knows what the goal is of the business they need to establish goals as a team that will help the company work towards their big picture goal.

- Individually – Once the sales department knows what the goals of for their department each person is able to set their own individual goals that will help the team reach their goal together.

However, goal setting will get you nowhere if you are setting the wrong goals. In order for your goals to work they need to be SMART. That means they need to be Specific, Measurable, Achievable, Relevant, and Time-Bound. Here is the difference:

Example of setting a goal that is not SMART – I want to increase sales

Example of turning this into a SMART goal – I want to increase my rate of closing sales by 10% by the end of the 4th quarter.

If you set the first example as your goal you have no way of holding yourself accountable for the goal. There is no deadline and there is no real way to measure if you are getting where you want to be because there is no specific number you are trying to reach.

-

Make a plan

Once your sales team has their goals in place it is time to make a plan to reach them. This won’t surprise you, but the majority of people either don’t set goals or they do not achieve the goals they set. That is because they don’t make a plan. Life is busy and happens quickly. If you don’t make a plan each day is going to continue to go by. You will be working hard to keep up with the items that you need to do for the day, but you will not be getting ahead. You will make no progress towards your goal, and if you do it will be by accident.

Break your SMART goal down into actionable steps. If you take the example of the SMART goal above here are some steps you could put into place:

- Make 15 calls each day before doing any other task

- Follow up with each customer within two business days of the first conversation

- Attend a weekly networking event to make new connections and spend 90% of the time talking with people I have never met before

These are just a few examples to get you started. When your goals is in place you need to look at it and think about what steps you need to do in order to realistically accomplish your goal by the deadline.

-

Don’t let failure stop you – learn from it instead

It takes special people to work in sales. It is the one department in business that has to deal with constant rejection (OK, any maybe the customer service department). That can be difficult to deal with and bounce back from. One of the main reasons that people do not set SMART goals is because they are afraid of failing by not accomplishing the goal they set for themselves. However, not reaching a goal is not something to be afraid of. It is something to learn from.

Sales teams would find far greater success if they started sharing failures with each other in order to learn from them as a team. If a lead on sale fails to convert or the team as a whole fails to meet their monthly goal, what happens? It’s a failure, so what does that mean? It should mean that you know have new information to evaluate in order to keep working towards your goal. Use this new information to determine what changes you need to make in order to hit your goal the next time.

Be strategic as a team

The main things that hurt a sales team is the fact that they never work as a team. Each sales person is working to accomplish the same goal. When the members of the team come together and are strategically working towards the same goal, a shift will begin to happen in their minds. This is when a sales team really starts to win.

There is no getting around the fact that the holiday season is busy for everyone. As consumers begin making their holiday purchases many small businesses struggle to keep up with orders. It can be difficult for them to have the working capital they need. They have to have funds to purchase the material they need to produce and ship their products. It is the perfect time for merchants to secure an alternative business loan, but many are too busy to realize their options. Here is how you can help:

Contact past customers

Start by running through your list of customers that are ready for a chance to renew or those that you have worked with in the past. As their business increases over the holiday season there is a chance they could use a little extra working capital to keep up with their necessary purchases. It is always easier to work with merchants that have already used your services in the past. They understand how it works and the benefits that it brings them.

With past or current customers, you don’t need to make a hard sell. You have a relationship built with the company, so contact them to check in. Ask if there are any additional services that they are in need of.

Think like your customer

If you want to provide your customer with the products and services that they need you need to think like them. What are their pain points at this moment in time? With the fourth quarter underway there are a few positions your client might relate to:

- The money isn’t coming in fast enough – With the year coming to an end the budget is running out. Sales may have been good so far for the year, but the receivables aren’t coming in as fast as the payables.

- Expenses are covered but there isn’t anything leftover – A business cannot gear up for the holiday rush without the funds available to use. As the old saying goes, “it takes money to make money”. If a merchant wants to bring in extra sales for the holiday season they need access to the funds to help them get started.

- Ready for growth but can’t make the jump – The merchant has been steadily growing and has hit the point that they cannot grow any further without additional working capital. They are poised for growth and just need the resources to make it happen. if they can find the capital they need they will go into 2018 stronger than ever.

Identify the pain point of the merchant and let them know you understand. Then, show them that you have the answer.

Be honest

Honesty is always the best policy, even in sales. No one likes to be sold to. Think of how it feels when you walk into a store and it feels like the salespeople are ready to pounce. You do not want your customers to feel like that. Always do what is best for your customer. Show them that you care about their business. Then, actually do it.

Help them identify what issues they are having. Then show them the product or service that can meet their needs. If you are working with a merchant that needs additional funds to make it through a busy fourth quarter show them how you can help. Do not try to sell them on a product that is not going to meet their needs. The minute that someone knows that you are just trying to sell them on something without caring if it is a good fit for you, you will lose their trust. Always be working to help your customer and you will be rewarded.

Spend time doing follow up

2017 has been a busy year for people including those you work with. If you had conversations with merchants that didn’t result in them taking action now is a good time to follow up. If these merchants were in need of additional working capital at some point during the year there is a good chance they still are. Recontact them to follow up. They may be more comfortable with the idea of it now, or they may be in a situation where they truly need it to make it through the fourth quarter

Look for new ways to contact them

While email and phone calls still work, there are new ways to do business. Once the holidays come schedules get busier and people are spending more time out of the office. That means the best way to contact them is via their cell phone. Many different surveys have found that almost all text messages are viewed and usually within minutes of being received. What does that mean to you? You should be using text messages to reach your customers. Ask their permission when you first speak with them and then don’t be afraid to use it. People are more likely to respond to a quick text message if they are out of the office then they are an email or phone call.

The fourth quarter is here and merchants everywhere are in need of additional working capital to make it through the holiday rush. They are searching and stressing about how to make ends meet as they push through this busy time. You have the answer they are looking for. Look for opportunities to help them, be genuine, and you will have customers for life.